Pe ratio formula

This is a high PE ratio but it may make sense because of. The formula in cell C9 is as follows C4C5C6 C7.

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Capital expenditure or CapEx are funds used by a company to acquire upgrade and maintain physical assets such as property industrial buildings or equipment.

. Since the Nifty 50 is a bellwether index the Nifty PE is used as a gauge to know if markets are expensive or cheap. This formula takes cash plus securities plus AR and then divides that total by AP the only liability in this example. From April 2021 Consolidated earnings is used to calculate Nifty.

It is possible for a display to have different horizontal and vertical PPI measurements eg a typical 43 ratio CRT monitor showing a 12801024 mode computer display at maximum size which is a 54 ratio not quite the same as 43. Tata Steels standalone PE is 49x while the consolidated PE is around 114x. It is calculated as the proportion of the current price per share to the earnings per share.

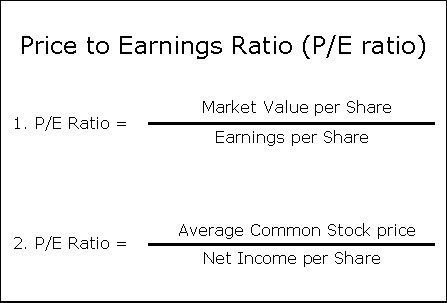

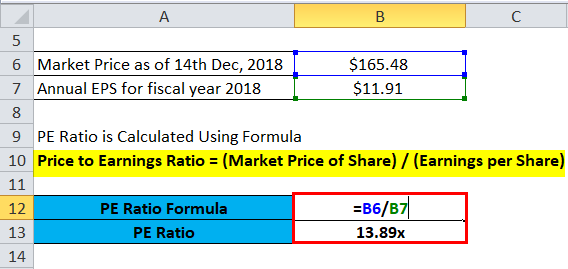

Price to Earnings Ratio Market Price of Share Earnings per Share PE 165481191. An object in such an orbit has an orbital period equal to Earths rotational period one sidereal day and so to. It depends on many factors.

According to the NSE website The Nifty 50 PE. It is calculated by dividing total earnings or total net. PE ratio is based on comparing the stocks closing price with its per-share earnings over time.

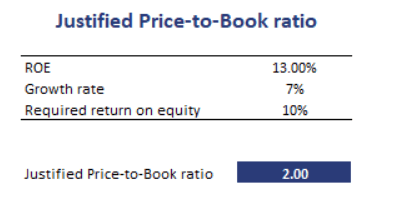

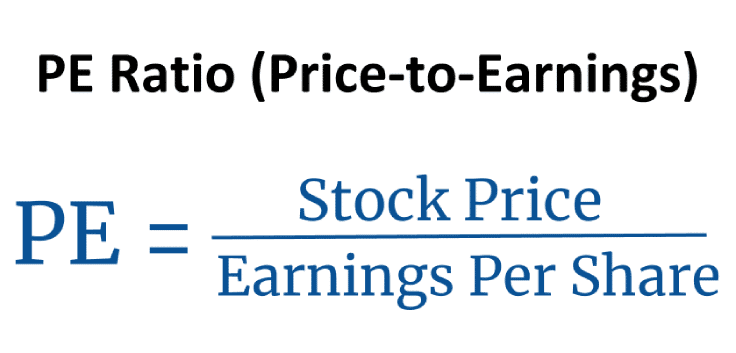

The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share and the companys expected growth. PE Ratio - Price-to-Earnings Ratio Formula Meaning and Examples The price-to-earnings PE ratio is the ratio for valuing a company that measures its current share price relative to its per. You divide a companys market capitalization by its book value.

The basic PE formula takes the current stock price and EPS to find the current PE. We will take up the denominator first. A geostationary orbit also referred to as a geosynchronous equatorial orbit GEO is a circular geosynchronous orbit 35786 km 22236 mi in altitude above Earths equator 42164 km 26199 mi in radius from Earths center and following the direction of Earths rotation.

2023 Nissan Altima gets upgraded everywhere but under the hood. This is why the PE ratio is sometimes referred to as the earnings multiple or just multiple. The formula to calculate the market to book ratio is very simple.

The result is 55. Let us calculate the same for ARBL. PE Ratio Current Market Price of a Share Earnings per Share Price to Earnings Ratio is one of the most widely-used metrics by analysts and investors across the world.

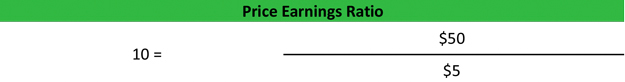

For example a ratio of 15 would mean that investors are willing to pay 15 for every dollar of company earnings. It signifies the amount of money an investor is willing to invest in a single share of a company for Re. The same when applied to the Nifty 50 stocks becomes the index PE ratio.

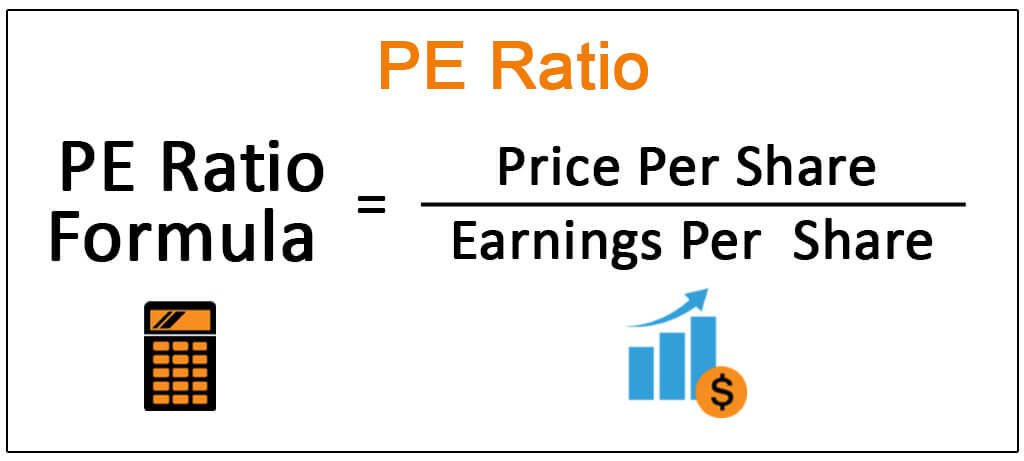

The formula to calculate the PS ratio is. The formula for the PE ratio is PE Stock Price Earnings Per Share. PE Ratio Formula Explanation.

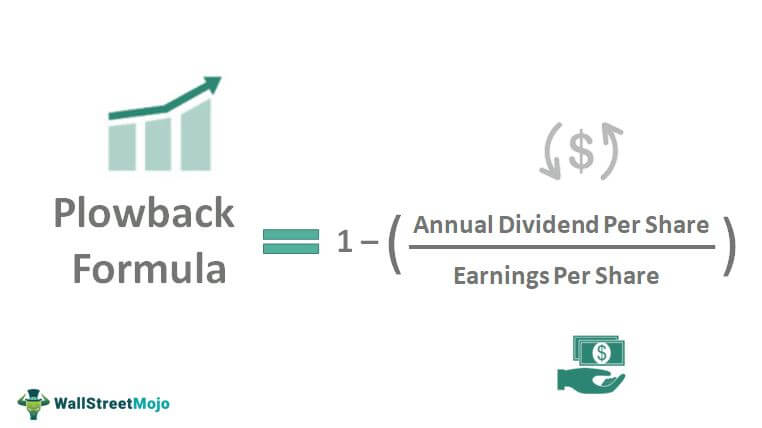

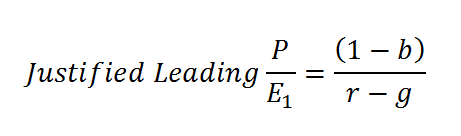

The formula for the PEG ratio is derived by dividing the stocks price-to-earnings Price-to-earnings The price to earnings PE ratio measures the relative value of the corporate stocks ie whether it is undervalued or overvalued. PE Ratio is Calculated Using Formula. R Required Rate of Return.

On the other hand the Shiller PE ratio was at 133 its lowest level in decades correctly indicating a better time to buy stocks. The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. Price to sales ratio Current Share Price Sales per Share.

What is PE Ratio Formula. Applying the PE formula and calculating the PE ratio. SP 500 Historical PE Ratio 120 Years According to historical data the SP 500 average PE ratio was 1334 between 1900 and 1980 while the average ratio changed to 2192 19812021 over the next 40 years.

PE ratio is considered a key valuation metric to know how expensive a stock is in relation to its peers. Justified PE Dividend Payout Ratio R G. 1 of its earnings.

Capital Expenditure CAPEX. How Does the PE Ratio Price to Earnings Ratio Work. Price to Earnings PE is one of the most popular ratios formulae that are being used by investors for valuing companies and taking investment decisions.

It denotes what the market is willing to pay for a companys profits. PE ratio compares a companys stock price with its earnings per share and helps determine if the stock is fairly priced. Heres the formula.

If earnings per share EPS is lower than zero then that causes the stock to have a negative PE ratio. But what is a good PE ratio. Check SP 500 PE Ratio SP 500 Shiller CAPE Ratio By Month 1945-2022 According to historical data the average Shiller PE ratio was 1448 between 1900 and 1980 while the average ratio has changed to 2264 19812020 over the next 40 yearsThe highest ever ratio is 4377 which was measured in 2000 after the market crash and the lowest was 512 found in 1921.

Thus using just the PE ratio would make high-growth companies appear overvalued relative to others. Price-Earnings Ratio - PE Ratio. But they can still be immensely profitable and seem cheap according to other metrics such as the PE ratio.

So dont make any investment decisions based solely. In general the PE ratio is higher for a company with a higher growth rate. Share Price Earnings Per Share PE Ratio.

To arrive at a company. The PE ratio was high because earnings were depressed. The numbers below are for demonstration purposes and may not be up-to-date Microsoft stock was trading at 165 per share and its EPS in the prior 12 months was 530.

However earnings per share is sensitive to various accounting methods so it doesnt always imply that a stock is a bad investment. With the PE ratio at 123 in the first quarter of 2009 much higher than the historical mean of 15 it was the best time in recent history to buy stocks. Same goes with EPS.

A ratio above 1 indicates that a business has enough cash or cash equivalents to cover its short-term financial obligations and sustain its operations. Nifty 50 PE Ratio Formula Total Free Float Market Capitalisation of all 50 companies Total Free Float Profit after Tax PAT of last four quarters of all 50 companies. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

Rewriting the formula above can tell us the pixel density PPI of the image on the monitor display. Lastly divide the price per stock as in step 1 by the earnings per share Earnings Per Share Earnings Per Share EPS is a key financial metric that investors use to assess a companys performance and profitability before investing. There is standalone and consolidated.

That means Microsofts PE ratio was 165 530 311. G Sustainable Growth Rate. PE Ratio Market Cap Net Income.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding. How to calculate the market to book ratio.

Uznanie Trym Przebranie Price Earning Ratio Calcul Niesamowity W Ciagu Matematyka

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Uznanie Trym Przebranie Price Earning Ratio Calcul Niesamowity W Ciagu Matematyka

P E Ratios Howthemarketworks

Price Earnings P E Ratio Analysis Formula Example

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Plowback Ratio Formula Examples How To Calculate Plowback Ratio

S P 500 S Justified P E Ratio Nysearca Spy Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

/interestcoverageratio_final-9c844b89a7744514b53bc16618a6fc9d.png)

Interest Coverage Ratio The Formula How It Works An Example

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Price Earnings Ratio Formula Examples And Guide To P E Ratio

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Is Negative Price To Earnings A Bad Sign For Investors Trade Brains

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Uznanie Trym Przebranie Price Earning Ratio Calcul Niesamowity W Ciagu Matematyka

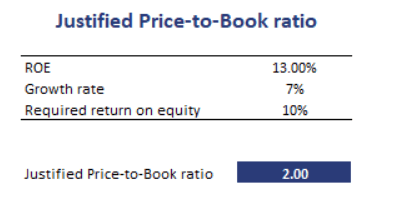

Justified Price To Book Multiple Breaking Down Finance